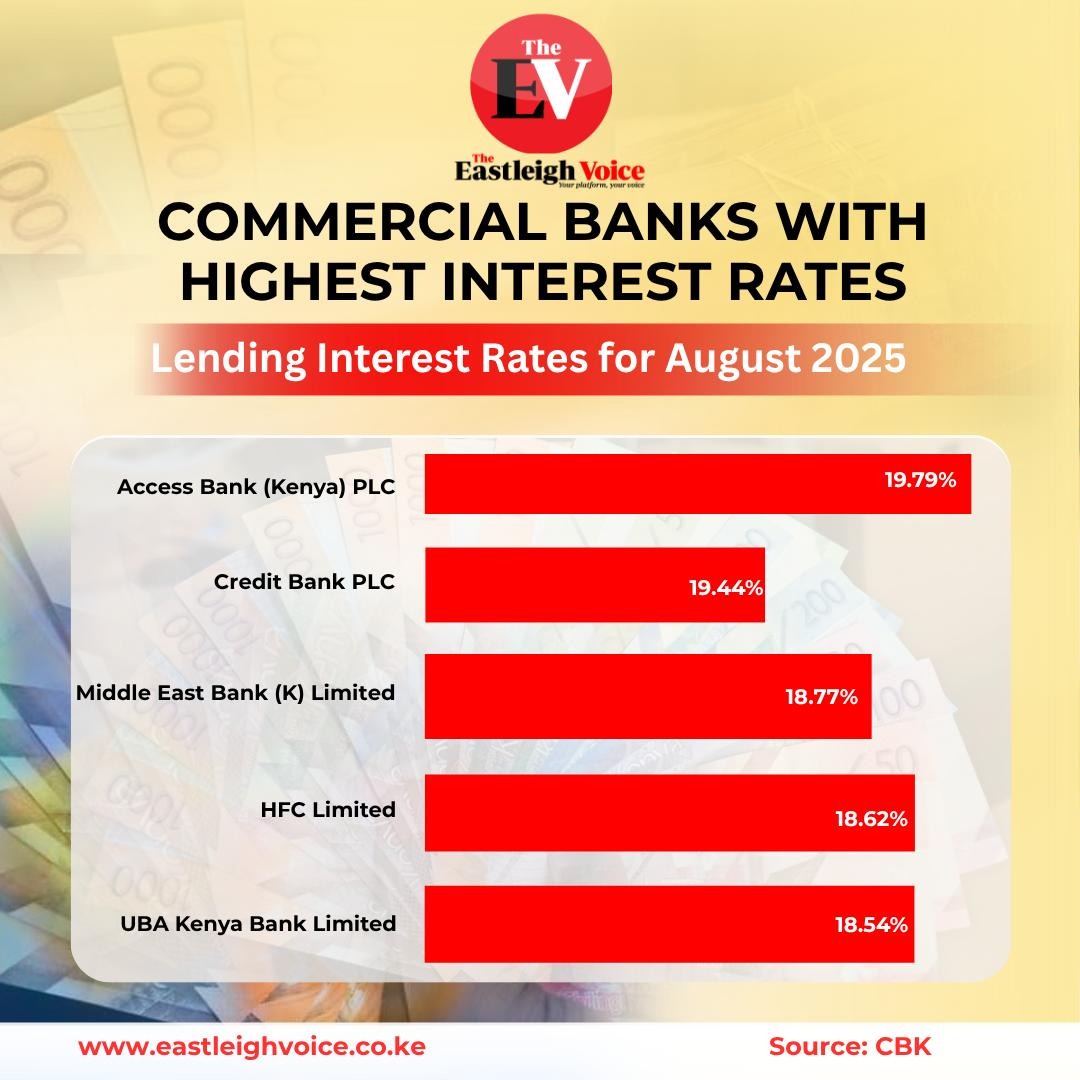

Commercial banks with highest interest rates

These elevated rates highlight a competitive banking sector where the cost of credit differs significantly, directly impacting borrowers’ financial burdens.

In August 2025, lending rates among Kenyan commercial banks varied sharply, with some institutions charging significantly more than others, affecting both individuals and businesses seeking credit.

Access Bank (Kenya) PLC topped the list with the highest lending rate at 19.79 per cent, making it the most expensive option for borrowers during the period. Close behind was Credit Bank PLC, which offered loans at a rate of 19.44 per cent.

More To Read

- Kenya Kwanza adds Sh3 trillion to national debt in three years, CBK reveals

- CBK warns of rising debt distress, urges fiscal coordination

- MPs question rising debt despite Treasury’s reduced CBK borrowing

- CBK data shows Sh344 billion decline in mobile money transactions, steepest drop in 18 years

- CS Mbadi tables new banking rules targeting non-compliance, unethical practices

- CBK targets Sh40 billion in new Treasury bond auction

Other high-cost lenders included Middle East Bank (K) Limited and HFC Limited, with rates of 18.77 per cent and 18.62 per cent respectively. These institutions also contributed to the upper end of the borrowing cost spectrum.

UBA Kenya Bank Limited rounded out the top five with a lending rate of 18.54 per cent.

These elevated rates highlight a competitive banking sector where the cost of credit differs significantly, directly impacting borrowers’ financial burdens.

Other Topics To Read

Top Stories Today